The current main markets of the bag industry are concentrated in Europe and the United States.In 2024, the global handbag market splits its fastest growth between APAC and LATAM.Bags Brands eye these regions for scale, speed, and local flair.

1. Why the APAC Bag Market Is Exploding

- Market Size and Speed

- APAC’s 2024 handbag market hit $17 billion.

- Forecasts show a 7.7% CAGR through 2030, reaching $26.2 billion.

- Add backpacks and luggage for $21.6 billion in 2024 and a 4.4% five-year CAGR.

- Shifting Consumer Picks

- Tote bags top “commute + shopping + daily” needs for urban women.

- Satchel messenger bags shine in 2025, winning white-collar fans.

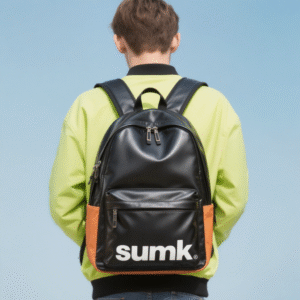

- Backpacks & travel bags now mix function with fashion as tourism rebounds.

- Brand Battle: Luxury, Niche, and Function

- Luxury hits: Hermès posted 20% APAC growth in Q1 2024. Birkin and Constance remain hot.

- Local challengers: JW PEI, Senreve, and EMOTIONAL WORLD use design and social targeting to stake claims.

- Function players: Antler, Samsonite, and Nike lock in business, sport, and travel segments.

2. How LATAM Bags Win Hearts and Wallets

- Market Scale & Drivers

- LATAM’s handbag market reached $5 billion in 2024.

- It will grow at a 5.4% CAGR to $6.8 billion by 2030.

- Travel bags surge at a 7.3% CAGR, doubling from $1.2 billion in 2023.

- Shopper Choices

- Fans buy Totes and Satchels, but high-end clutches see the fastest growth.

- Niche packs—anti-theft backpacks, parent-and-child bags, outdoor packs—gain ground.

- Brand Scene: Local Strength Meets E-Commerce

- Homegrown names like Mario Hernández (Colombia) and Cia Hering (Brazil) dominate offline.

- E-commerce rules: Mercado Libre and Linio lead cross-border sales.

3. APAC vs LATAM: Side-by-Side Comparison

| Metric | APAC | LATAM |

|---|---|---|

| Market Size & CAGR | $17 B, 7.7% | $5 B, 5.4%; Travel bags 7.3% |

| Top Categories | Tote, Satchel, Travel Bags | Tote, Satchel, Clutch |

| Brand Mix | Luxury, Local, Functional | Local, Imported Value |

| Channels | Online + Offline + D2C | E-commerce Dominant |

4. Top 4 Regional Strategies to Win

- Glocal Product Design

- Mix local art & symbols. In LATAM, weave Inca or Aztec patterns into travel bags.

- Category Focus

- Prioritize star products in travel and commuter segments. Aim for unmatched utility and style.

- E-commerce & Social Media Push

- Join key platforms (Mercado Libre, T-mall). Optimize your D2C site.

- Partner with local KOLs. Use targeted social ads to boost traffic.

- Region-Tailored Pricing

- APAC: Offer high-end and midrange lines. Cover all budgets.

- LATAM: Cut costs without cutting quality. Simplify channels to protect margins.

The Bottom Line: Localize or Lose

APAC’s massive scale and LATAM’s e-commerce surge prove one fact: one-size-fits-all won’t work. Brands must adapt on product, price, channel, and message to drive lasting growth. In 2025 and beyond, region-driven data and true localization will fuel the next wave of bag industry wins.